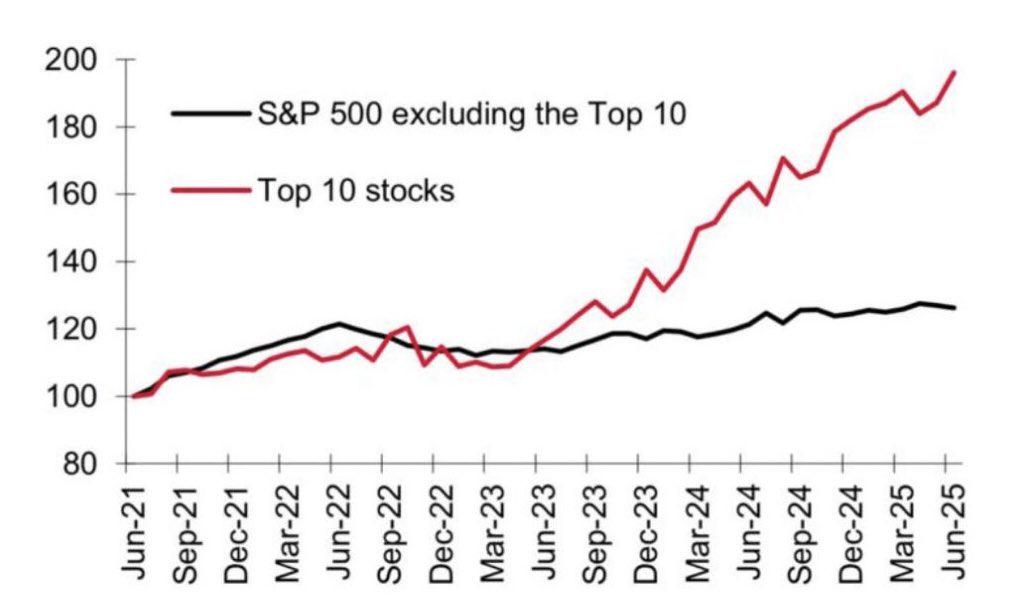

Top 10 vs SP 500 S&P 490

The Top 10 stocks in the S&P 500 carry the entire indice. Nothing new there!

Thanks in part to the AI boom, it looks more like the Top 10 stocks (aka Magnificent Seven) and the lackluster (in comparison only) S&P 490.

S&P 500 Top 10

| Rank | Company | Ticker | Index Weight |

|---|---|---|---|

| 1 | NVIDIA | NVDA | ~8.06% |

| 2 | Microsoft | MSFT | ~7.37% |

| 3 | Apple | AAPL | ~5.76% |

| 4 | Amazon | AMZN | ~4.11% |

| 5 | Meta Platforms | META | ~3.12% |

| 6 | Alphabet (Class A) | GOOGL | ~2.08% |

| 7 | Alphabet (Class C) | GOOG | ~1.68% (approx.) |

| 8 | Broadcom | AVGO | ~2.57% |

| 9 | Berkshire Hathaway | BRK.B | ~1.61% |

| 10 | Tesla | TSLA | ~1.61% |

(Note: GOOG and GOOGL are separate share classes of Alphabet, so some lists collapse them together or position them slightly differently.)

Warren Buffett’s Berkshire Hathaway is the only “non-tech” stock here. Nonetheless, 25.76% of BRK portfolio is made of AAPL stocks. So we can say that BRK is 1/4 tech stock.

Despite being on my watch list, I haven’t take much attention to Broadcom (AVGO). Less media exposure than the Magnificent 7.

Your best bet to get maximum exposure to the Top 10 stocks in one ETF/stock would be to buy the ETF MAGS.

MAGS – The Roundhill Magnificent Seven ETF offers equal weight exposure to the “Magnificent Seven” stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. MAGS is the first-ever ETF to track the Magnificent Seven.

Personally, I prefer NVDA stock currently.

And for one reason or another, I prefered to create my own “ETF” MATMA. Buying Meta, Alphabet, Tesla, Microsoft, Amazon in equal part with the same amount of capital each. Apple and Nvidia weren’t included since I see them as superior to the other Magnificent 7 stocks. But I must admit that META is particularly interesting these days.

Health & Wealth

![]()